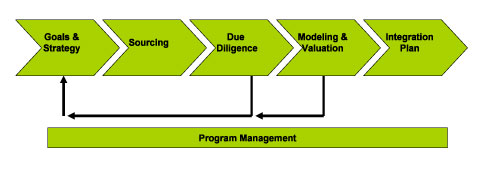

m&A programs

We have a long track record in working corporate acquirers in developing and conducting acquisition programs. Our value added includes:

- Time and focus – at its most basic level, we provide resources to corporate development executives to help plan, launch and conduct acquisition programs. We encourage acquirers to adopt a concerted focus on M&A, treating it like other major initiatives.

- Strategy Development – An acquirer is well-advosed to address a number of strategic questions, including goals, acquisition criteria, timing, best sequence of acquisitions, integration philosophy and so forth. We facilitate the process of developing these points of view.

- Screening – we work with corporate development teams to develop screening criteria and conduct searches.

- Market drivers – we develop insight into changes in technologies, competitive economics, industry boundaries/convergence and customer needs such that we can help develop out-of-the-box ideas on emerging sources of value

- Valuation and strategic due diligence – We have considerable experience in assessing the strategic industry positioning of a potential candidate, modeling its financial trajectory and assessing risk factors.

- Merger integration – We assist in the development of the merger integration game plan, bringing to bear knowledge on process analysis and process management

Growth insight corporate development program