Business sale/divestiture

Growth Insight finds buyers for mid-market businesses. The exit may take the form of a partial or complete sale. It may involve retirement or a period of management continuity.

Our process includes:

- Working with the seller to fully understand and articulate the tangible and intangible assets the business offers to a buyer

- Developing a target exit price point

- Finding the several best buyers for the business, and conducting a process that leads to a successful sale

- Structuring the right personal exit path for the seller – e.g. length of management continuity, post-deal roles, post-deal options, etc.

- Managing the sale process from initial expression of interest to closing

In positioning the business with buyers, we systematically identify and quantify sources of leverage that the transaction will create. Rather than valuing the business simplistically on an EBITDA multiple, we inventory and quantify the synergistic benefits of the transaction, and help negotiate a sharing of that benefit. Sometimes these benefits are a very significant portion of the purchase price.

When is the best time to sell?

How is your personal income stream affected by this timing decision? What is best for your employees? With likely increases in capital gains tax rates, are you better off selling now? Is it better to wait, to more fully develop the business and make it more valuable to an acquirer? Will multiples rise when the industry becomes stronger? What happens if the best acquirer for your business buys someone else first?

All of these factors affect your timing decision. To receive our article, “When is the Best Time to Sell” please contact Lisa Dickholtz at 203-659-4751.

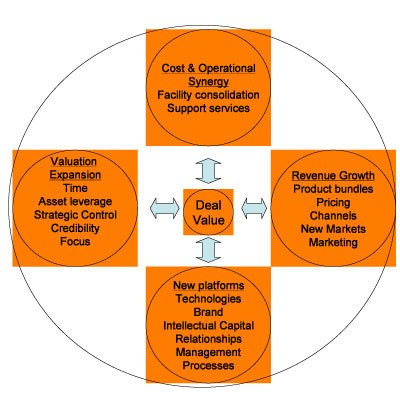

We use our Value Field Analysis (VFA) framework for finding these leverage points. In the VFA, we start with the lowest sources of value creation - shared services, facility/overhead integration and other cost and operational synergies. Sometimes this is the predominant source of deal value added; it often distinguishes one buyer from another.

Value Field Analysis

Moving beyond cost & operational synergies, we examine revenue growth opportunities. In our experience, these opportunities can be profound. We have seen many situations where the acquirer can bring the seller’s products and services through its distribution channels, or into new markets, thus explosively growth the top line. Depending on the industry structural context, there may be opportunities to bundle products and/or affect pricing over the long term.

The deal becomes even more strategic, to the acquirer, when it creates an entirely new growth platform. There are many examples where the acquirer can better leverage the sellers’ technology, know-how or patents. There are many situations in which the seller has a brand or a set of customer relationships that the acquirer can exploit.

Finally, particularly with public company acquirers, the deal may expand the buyer’s valuation. Even where the deal is small, investment analysts, CEOs and Boards may see the deal as locking in a strategic position within an industry they are trying to grow in. Doing the deal precludes a competitor from buying the company; it accelerates time-to-market; it underscore’s the acquirers’ strategic position.

When these factors are not taken into account, money is left on the table. We witnessed the pain of one set of sellers who, negotiating for themselves, accepted a $10 million offer which could have been $15 million had they realized that the buyer had no other options that would satisfy their public market needs. We witnessed another seller who sold his business for $20 million – over 1.5x sales – only to see the acquirer do a second deal at 2x sales months later.

Sometimes, it pays to postpone selling, until the business can be strategically positioned to maximize its value. In those situations, we work with owners/CEOs, through our Corporate Value Enhancement program, to install strategic and operational improvements to improve profit growth, and enhance the value of the business upon sale.